If you don’t want any expert help and wish to do your taxes on your own, the plans under the “I’ll do my own taxes” will be your best choice. Depending on the level of expertise you want and the financial situation you’re in, the price will vary. TurboTax offers a range of pricing plans. Tax Tips For Low-Income Earners In 2023 How Much Does TurboTax Cost? They will ask questions depending on your investments, to ensure you’re getting the maximum deductions and highest return. If you have rental income or have been investing in stocks, bonds, ETFs or Crypto, TurboTax offers users guidance on these matters. TurboTax offers a pension optimizer tool that helps you split up to half of your CPP or other pensions with your spouse to save on taxes owed. While you will have all the support you need to file your taxes on your own, you can always get a TurboTax tax expert to prepare your tax return for you and file it on your behalf. Instead, you’ll get real-time information that shows you how it affects your refund or tax owing as you enter your information. This tracker will keep you updated throughout your tax filing so you don’t have to wait until you’re almost done to see what the final total is. That way you can make an informed decision on how you should contribute to your RRSP. The RRSP optimizer will show you examples of various contribution amounts and how they will impact your tax refund or amount owing. Tax returns filed online are submitted directly to the CRA thanks to NETFILE, which means you can get your tax refund shortly after you’ve completed your tax return.

#Turbotax loan 2018 professional

Similarly, if you are ever audited by the CRA, TurboTax will provide you with professional representation and deal with the CRA for you. Moreover, if the CRA finds any discrepancies in your tax return and you are charged a penalty as a result, TurboTax will reimburse you whatever you have been charged (plus interest) thanks to its 100% accuracy guarantee. TurboTax offers a 100% guarantee that you get the highest tax refund possible. One of the fears of filing your taxes yourself is missing out on different tax credits and deductions, which can result in lower tax refunds. They’ll also work with you line-by-line to make sure you don’t miss anything. TurboTax has real tax experts available to answer questions and give advice as you move through your tax filing. Below are some of the features TurboTax offers: Expert Advice From Tax Experts

TurboTax has a number of features that Canadians with little or advanced tax knowledge can benefit from. Ideal for both simple tax filings and more complex situations, TurboTax is fully equipped with all the features needed to file accurately and with ease.įile your taxes with TurboTax Get Started What Does TurboTax Offer? That said, it’s still a relatively affordable tool for Canadians to use to file their taxes, especially when you consider everything that you get with it and what accountants charge for tax preparation services.

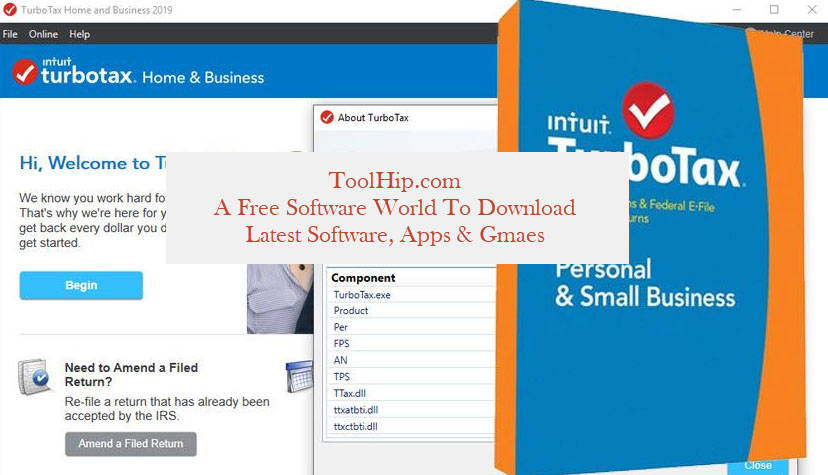

#Turbotax loan 2018 software

TurboTax is among the more extensive tax preparation software products out there, but the features and ease of use might make it worth the few extra dollars. Millions of Canadians have already used TurboTax over the past couple of decades that the tool has been around, and as such, it’s developed an excellent reputation. With TurboTax, you can file your taxes online and submit your tax return directly to the Canada Revenue Agency (CRA). So, does it stand up to its name and is it the right option for you? Check out our TurboTax Canada review below. Enter TurboTax, one of the most popular tax softwares available in Canada and TurboTax is one of the most popular. Whether you’re dealing with, filing your taxes, debt repayment or checking your credit score there are great do-it-yourself options out there.

Just because filing taxes in Canada is mandatory, doesn’t mean it needs to be really hard and doesn’t need to involve an accountant.

0 kommentar(er)

0 kommentar(er)