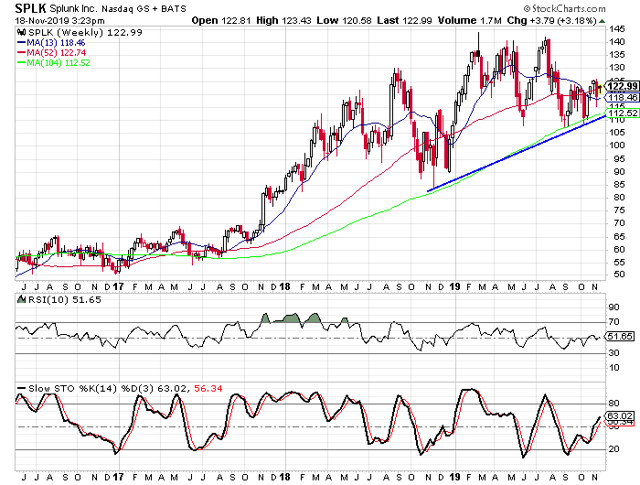

This will result in valuation appreciation as investors see that the growth in the balance sheet has returned and see the value of the growing SaaS business. When will the transition end? I think Splunk is at the peak of business transition today, and the company will be nearing the end of the business transition in the next 2-4 quarters. Therefore, because the increase in operating loss was the result of faster growth, temporary, and transition, I think the decline in stock price following earnings only created more opportunity. The guidance for the next quarter shows strong top-line growth and a negative 25% operating margin, a significant improvement from this quarter, and management said (at 36 minute and 40 seconds) that they are still planning for a 70% cloud gross margin exiting the year (this quarter's GAAP cloud service gross margin as 54.6% and non-GAAP was 60.3%), which shows that management still thinks the company's margin goal is achievable. If the above reason is true, not an excuse, then the recent negative stock movement only created an opportunity since it went down on simply a fear.Īdditionally, the guidance and the management's gross margin outlook were very positive supporting the management's reason, a one-time deployment cost, for a big loss. I don't expect to see the increased cost flow through for the rest of the year.

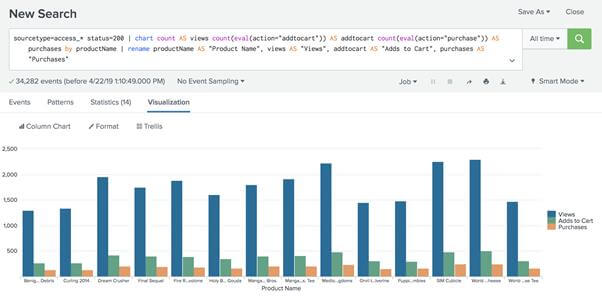

And so those were, I think largely mostly kind of one-time impacts. We did have higher OpEx related to cloud deployment costs for a bunch of new products and services that were launched in Q1. Second, during the conference call (at 24 minutes and 25 seconds), the management explained why the operating margin was lower than expected. Thus, it is only natural for Splunk's negative operating margin and net loss to temporarily increase as the company nears the end of the transition. First, the company is still in transition from licensing business to a SaaS business, and because the licensing business's cost of revenue is almost non-existent, Splunk's operating loss and margin will significantly fall as the company nears the completion of the transition.Īs the picture above shows, the licensing business's cost of revenue is far less than the cloud services. I think there are two reasons for this big loss. Now, moving on to what others call the bad side of the earnings report, Splunk reported a greater than expected loss of 471 million dollars or -35.4% Non-GAAP operating margin.

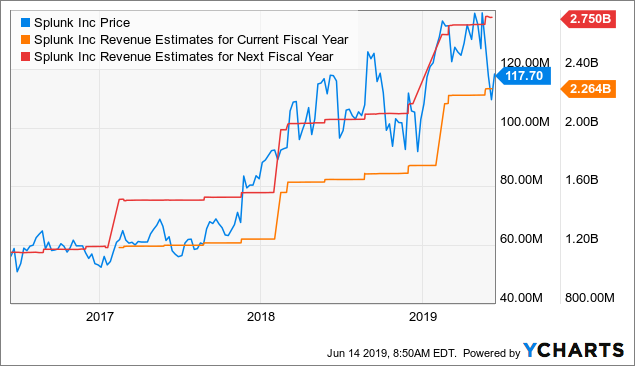

Thus, Splunk, as data gets more important, is growing at a very fast pace accumulating important new customers and growing its top line. Splunk's SaaS business despite stock price movement is still strong and booming, and some of Splunk's new customers include the United States Department of Defense, Bank of New Zealand, Chipotle (NYSE: CMG), CVS Health (NYSE: CVS), and Florida Department of Economic Opportunity. Cloud ARR reached 877 million dollars or up 83% year over year, and the total ARR reached 2.47 billion dollars or up 39% year over year. Instead, I think these reasons create opportunities.įirst, I'll start with the good side of the earnings report. I think these reasons, greater than expected loss and transitory business model shift, do not justify the stock movement. Splunk fell 9.5% after the earnings report because according to Barron's "Its numbers remain muddied by its business model shift." In other words, the transitory business model shift caused slower growth and larger than expected loss. Splunk's valuation is too low, and it will appreciate in the next few months. The intensifying competition is not a problem in the short term (2-3 years). I think the price action following the earnings report was absurd. As I've already said, I am still bullish on Splunk, so in this article, I will explain why I think this short-term decline creates more opportunities and why I bought more Splunk stocks. However, after the earnings report on June 2nd, the stock fell 9.5% the following day.

I still strongly believe that my bullish thesis stands. I also pointed out that Splunk's transition into a SaaS company is almost complete and its valuations during the company's transition have reached unreasonably low prices. My first argument in my previous article was that Splunk has an enormous TAM since more data is being created and data is becoming more valuable. Photo by David Tran/iStock Editorial via Getty Images Investment ThesisĮxactly one month ago, I wrote a bullish article about Splunk (NASDAQ: NASDAQ: SPLK) because I believed the stock was reaching unreasonably low prices or an undervalued territory in the era where data is becoming the new oil.

0 kommentar(er)

0 kommentar(er)